|

This is a continuation of a previous debate with RV, here and here. RV claims that I say that “the average prices of commodities are directly proportionate to the labour time socially necessary to reproduce them.”. I don’t because that is a mathematically ill defined statement. There is no such thing as an average price of different commodities since the commodities are incomensurable. You can not average the price of size 9 socks, Volkswagen Up cars, and 20cm lampshades. To form an average you need numbers of a uniform sort, which can not be done with distinct commodities. What can be measured is the correlation between the labour content of the output of industries and the money value of the output of these industries. What I do claim is : “One can allow an element of noise, a percentage error induced by temporary fluctuations of supply or demand whilst still accepting that the attractor for relative money values (prices) is relative labour values. In modern language, not available to Marx, we would say that labour content is strongly correlated with sale value in terms of money.“ It is this assumption that is absolutely crucial to the arguments that Marx uses for the analysis of relative surplus value in volume I of Capital. The analysis of capitalist exploitation is the most politically controversial part of Capital. RV has no difficulty in finding places in Vol 1 of Capital or in Theories of Surplus Value where Marx says, without elaborating much, that average prices do not correspond to values. This, as I say above, is a mathematically ill formulated claim, but let us read it charitably as indicating that Marx believed, as a follower of Ricardo, that profit rates equalised and that in consequence capital intensive commodities would sell at a premium relative to their labour content. He promises to explain all in a volume to be published later. But none the less his entire set of theoretical demonstrations rest on what he may perhaps have believed was a mere provisional assumption that relative prices are proportional to relative values. RV claims that this assumption is made because Marx is deliberately setting himself a hard task. He implies that the assumption of price/value proportionality makes Marx’s task exceptionally hard: He has to demonstrate that there is surplus-value even under the very restrictive assumption that average prices are proportionate to values. Marx singles out the most restricted, most difficult case, because he thinks it is only in this case that he can decisively make his point without there being any possible other explanation. It is true that Marx is setting up this assumption to exclude certain superficially easy but false explanations of surplus value. The simplest explains profit by monopoly power. The capitalist as a monopolist, in this version, makes a profit by selling commodities above their true value. Well there is little reason to doubt that individual monopolists do gain profit this way, but it fails as a general explanation for profits. If some capitalists are selling above relative values, others must be selling below them, so the gains of one would be cancelled by the losses of another. Although the monopoly theory is superficially attractive, it would therefore fail as an explanation for capitalist profit in general. In modern language, such deviations are a zero sum game. The next theory that Marx wanted to exclude was that workers were being cheated by the price of labour being below the value of labour. One of his rival socialist theorists like Rodbertus advocated this sort of account. So the insistance that commodities sell at their value was also intended to stress that labour power too, sold at its value. This was to obviate reformist projects according to which exploitation would end if all commodities, including labour power, could be made to sell at value. He argues instead, that even if labour power does sell at its value, surplus value will still exist. He does not doubt that at times the price of labour power falls below its value – falls to a level at which workers familes can not reproduce themselves. But he is guarding his argument against the simple trades unionist demand for a a fair day’s wage for a fair day’s pay. Instead he constructs his analysis of capitalist exploitation to show that even if workers are paid the value of their labour power they are still exploited. The solution must be the ‘abolition of the wages system’. This point is made explicitly in the last lines of Wages Prices and Profit. The equivalent terminating phrase in Capital is ‘expropriation of the expropriators’. The claims that profit arises from monopoly or under pricing of labour, whilst superficially plausible, are incapable of being integrated into a consisten overall system of social accounting – of the sort presented in Vol 2. In fact, I will argue, that the system of accounting in Vol 2 necessarily implies that the law of value – in the sense of a close correlation between prices and labour values must hold if capitalism is to reproduce itself. Dave Zachariah and I give a formal mathematical demonstration of this in a recent paper. I will give a demonstration by numerical example later. But for now, lets just ignore the reproduction models in Vol 2 and concentrate on the way that the coherence of Vol 1 depends absolutely on the law of value ( understood as necessary close correlation between prices and labour values ). I will now simple quote what I said on this in my original article and we can see if RV has been able to make an adequate response. Recall that Marx calls absolute surplus value, that surplus value produced by lengthening the working day. In his analysis of this he assumes that a proportional increase in the working day – say by 1/4 from 8 hours to 10 hours will result in a proportional proportional increase in the value added by labour during the day. He repeatedly switches between presentation in terms of money and equivalent proportional representations in terms of time. How does RV respond to this challenge? Is he able to derive an analysis of relative or absolute surplus value without assuming a strong positive correlation between labour content and price ? No he completely flunks the challenge because it can not be done. Instead he avoids the issue : It is indeed absolutely necessary for the analysis (“the process of breaking a concept down into more simple parts, so that its logical structure is displayed”) of how surplus-value arises in production to assume (= suppose) that commodities are exchanged at their values. Even if they actually don’t. In other words, when you abstract from value-price deviations, that doesn’t mean that you think they aren’t there. It just means that you think they’re not relevant to what you’re trying to demonstrate (of course maybe they are relevant, and in that case your demonstration will not stand the test of practice). It means that it renders the analysis unnecessarily complex and doesn’t allow you to conclusively demonstrate anything. At least, that’s how Marx sees it. He makes two points

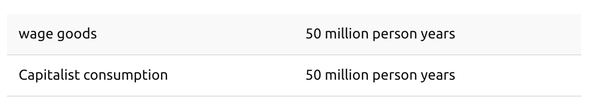

But this is not good enough. It is not a matter of abstracting from price value deviations. A strong positive correlation between prices involves the assumption that there are deviations. But that the deviations, the noise, is small compared to to the signal, this is literally what correlation measures. For him to rebut the point that Marx’s analysis depends on this positive correlation it is not enough to say Marx was ignoring deviations. He would have to show that Marx’s argument would still hold if prices and values were uncorrelated. If prices were not correlated to labour content, then the use of labour saving weaving machinery would not have depressed the price of woven cotten and impoverished the hand loom weavers in the way Marx describes in his anlysis of machinery. The whole argument would fall down. On his first point. If the theory of surplus value mathematically rests on the assumption of labour value to price proportionality, and if in reality it turns out that prices are uncorrelated with values (as Kliman claims ) then Marx’s theory would be dead wrong and we should reject it outright – as the bourgeois economists have long claimed. But if Marx believed his theory of surplus value to be true, then he must have believed that the premises on which it rested were true premises. Again, I repeat the challenge, RV and Kliman for that matter, have to show that Marx’s theory of surplus value can be reconstructed on the assumption that price and value are uncorrelated. Of course if RV can not reconstruct the theory of surplus value without assuming that the law of value holds, then the theory of the declining rate of profit – which depends on the theory of surplus value would also be unsound. Impossible things“Alice laughed. ‘There’s no use trying,’ she said. ‘One can’t believe impossible things.’ It is easy for RV to find passages where Marx supports the Ricardian theory that profit rates equalise, and that this will induce systematic deviations between price an value. Marx was, on this point a completely uncritical Ricardian. This is why, for a long period from the 1960s the neo-Ricardian school were able to make hay with their criticisms( for example Steedman, Ian. Marx after sraffa. London: NLB, 1977). Marx may well have thought that “differences in the average rate of profit in the various branches of industry … could not exist without abolishing the entire system of capitalist production.” But as Dodgson points out, in the youth of a theory one can believe many impossible or contradictory things. Marx both believed that Ricardo was right about the equalisation of profit rates, and that Marx’s own theory of reproduction was right. But this, was a belief in the impossible. They can not both be right. This is why there is a ‘transformation problem’. Marx seems not to have been aware of the problem, but it was pointed out after his death by Samuelson, the neo-Ricardians, etc. It is unfortunate that Kliman and some other older Marxist economists have gone to inordinate lengths to try to hold onto pre-prandial fantasy, doubly unfortunate if younger comrades like RV never get to eat. Marxist economists have a choice, they can hold fast to the law of value, the theory of surplus value and the analysis of reproduction in Vol 2, or they can decide to go along with the Ricardian assumptions of the early part of Vol 3. If you hew to the Ricardian assuption as RV, Kliman, Harvey and Steedman do, then in one way or another you end up repudiating the law of value. Vol 2 deals with reproduction and turnover time, but it does all this on the basis of exchange at labour values. What was not apparent to Marx when writing Vol 3 was that it is actually the assumption of profit equalisation that leads to the economic collapse. One can grasp this if one starts out from the reproduction shcemes of Vol 2. Dave Zachariah show this in our lectures on the Kliman price theory here, starting from slide 99. We also have a video. In what follows I will give a simple example of why this is. What I will show is that if you allow for varying turnover times then and equal rate of profit disrupts the reproduction of the economy. Let us start by assuming we have a country with 100 million workers. If they are all full time workers then the annual net product in terms of labour value must be 100 million person years. We can divide the economy into three big sectors:

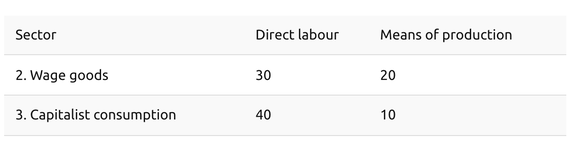

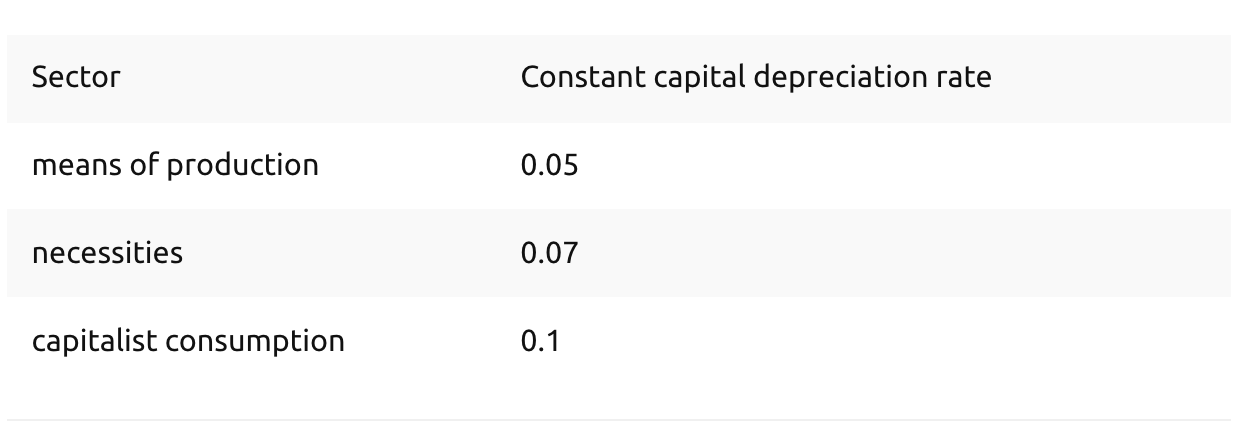

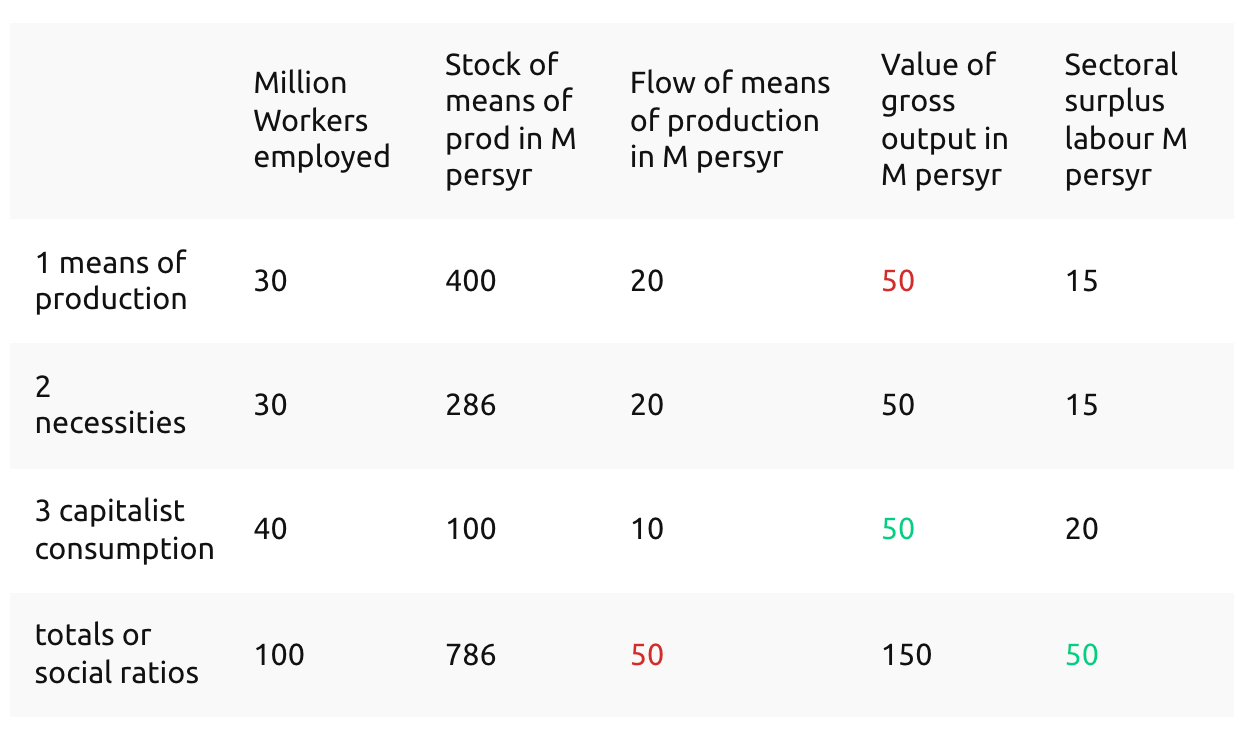

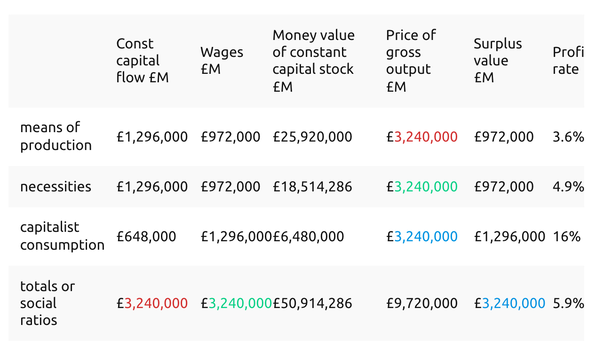

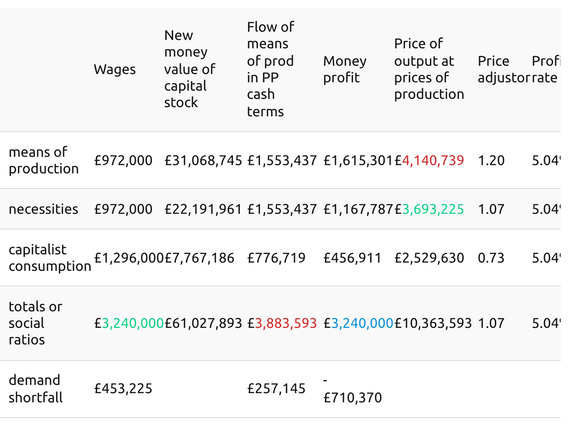

We will assume that the economy is in simple reproduction, neither growing nor shrinking, with no net capital accumulation. In that case the entire net product comes from sectors 2 and 3. The whole of sector 2s output is consumed by workers, so the labour required to make its output is the necessary labour time of the economy. The ratio between the sizes of sectors 3 and 2 expressed in person year terms gives the rate of surplus value. We will assume the rate of surplus value is 100% – well within the bounds of plausibility. That implies that the value of output of each of sectors 2 and 3 must be 50 million person years. That does not mean that 50 million work directly in each of sectors 2 and 3. Each must use up means of production supplied by sector 1. Let us suppose that wage goods use 20 million person years of means of production, and capitalist consumption 10 million. So at the next level of detail our situation is ( all figures millions of person years). You can view this as saying that 30 million workers are employed in sector 2 and 40 million in sector 3. That leaves 30 million workers out of the population who are employed in the means of production sector, 2/3 of whose net output goes to sector 2 and the rest to sector 3. This description covers the deployment of labour between industries, the social division of labour. At the same time it represents flows of value, both between industries and to final consumption. It is one of the advantages of labour value andalysis that there is this one to one correspondence between value flows and deployment of people. Production requires buildings, machines and vehicles, fixed capital that lasts several years. The flow from sector 1 to sector 2 is made up both of new machines and also of raw materials. We can go from a flow of value toa stock of capital if we know the turnover time. So if the turnover time of constant capital in sector 3 is 10 years, and the flow of new constant capital is 10 million person years, then the capital stock in sector 3 would be 100 million person years. This simply means that it will take 100 million person years at current technology to completely replace the capital stock as it wears out. This is the real meaning for the value of a capital stock – how long it would take people to rebuild it. It is often easier to work with the inverse of turnover time, the depreciation rate. In what follows I am assuming the following depreciation rates for sectors. This is based on the assumption that production of means of production will use longer lived capital equipment than the capitalist consumption sector. Steel rolling mills are longer lived than the computers and office supplies used by accountants etc. set an intermediate depreciation rate for the workers consumer goods industry. We can then set up a snapshot of the distribution of labour and constant capital in this economy. That it is capable of reproduction can be seen by checking that the total surplus labour 50 matches the output of sector 3 and that the total flow of means of production 50 in red matches the output of sector 1. These figures are all in million person years. But if we assume that there are 2160 working hours a year, each of which creates a value of £30 we can get the equivalent monetary table. Because the table is wide, you should use the scroll bar to see it all. Again we can verify that the system can reproduce. Colour codes show matching counsumption demands on the bottom row matching sector outputs in the gross output column. So if we assume prices are proportional to labour values, at £30 per hour then we would have a self reproducing capitalist economy. But if you look in the profit rate column you see that the rate of profit varies widely between industries. In fact this is just what we see if we look at a real capitalist economy – a wide dispersion of profit rates between sectors. But Ricardo, Marx, Samuelson, Steedman, Kliman etc thought ( or still think ) that such a dispersion of profit rates is somehow wrong. Surely capitalism should be fairer to capitalists than this? The law of value is unfair to capitalists! What a scandal! Surely they should all be able to earn the same rate of profit? Hence the ‘transformation problem’. How can we alter the law of value so that it is fair to all capitalists? Let us apply the iterative procedure for solving the transformation problem advocated by Kliman. At each time step we adjust the price of the output of each sector to get an equal rate of profit, holding total wages constant. That is to say we award to each sector a uniform profit rate. We calculate the profit rate such that it is the original total surplus value divided by the latest money valuation of the capital employed. This is to be consistent with Marx’s belief that the total surplus value will be unchanged under the transformation. Well lets see what happens after 5 iterative steps using the Google Slides iterative solver. I have added a column to show the price adjustor arising from prices of production. It means that means of production that have a labour value expressed in money of £1 must sell at £1.20 to equalise profit rates, necessities with a labour value of £1 must sell for £1.07 etc. As you can readily see, all sectors now have the same profit rate 5.17%. This is what the transformation procedure is intended to achieve – equal shares in surplus value for equal quantities of capital. Fairness and justice to all capitalists. Unfortunately the result is an economy that is now incapable of reproducing since for each sector, supply and demand are now out of alignment. Look at sector 1. Its output is priced at £4,140,739M, but the demand is only £3,883,593M. Clearly they do not match. The same applies to all the coloured figure pairs. Kliman has claimed that this kind of difference between purchased means of production and selling price does not matter; since means of production were purchased in the previous time period. There is, he claims, nothing to stop the capitalists in sector 1 selling their products at a higher price in the current period. But this does not apply to wages. The total wages paid were £3,240,000M but the capitalists in sector 2 have to sell their output at £3,693,225M to earn the uniform profit rate. There is a shortfall of £453 billion pounds between what workers are able to spend and the price that the capitalists want to charge. Clearly they can not sell them for this elevated price. If they sell them for £3,240,000M, which is all the workers have to spend, then their profit will be £714,562M not the £1,167,787 required by profit equalisation. Now look at the capitalist consumption sector. It is attempting to sell its output at £710 billion less than the money that the capitalists have as profits to spend. This gives the firms in this sector the opportunity to hike their prices – which will mean that their sectoral profit will rise by £710 billion. At that point the profit rate in sector 3 will run above the requisite average rate. ConclusionIf the law of value holds, and commodities sell at prices proportional to their labour content, then any social division of labour required by current technology and the current rate of exploitation can be reproduced. You get a set of prices at which inter sector supply and demand match. Each sector can sell its full output, pay wages and make a profit. The rate of profit will not be equal between sectors, but this inequality does not threaten the reproduction of the capitalist economy. If, on the other hand, some external planning body were to calculate what equal profit rates should be, and instruct all capitalists to sell at prices which would equalise profit rates, then you would get severe inequalities in inter sector supply and demand. Of course, in a capitalist economy there is no such planning body able to impose the hypothetical prices of production. But in socialist economies this has been a live issue. There was a planning body. It could impose prices. Should it impose prices of production? Samuelson famously proposed “A New Labor Theory of Value for Rational Planning Through Use of the Bourgeois Profit Rate“. Similar proposals came from some Soviet economists in the Khrushchev period. Stalin had argued strongly against the idea that a socialist economy must adopt the criterion of equal profit rates: If this were true, it would be incomprehensible why our light industries, which are the most profitable, are not being developed to the utmost, and why preference is given to our heavy industries, which are often less profitable, and sometimes altogether unprofitable. He here shows a practical awareness that smooth reproduction requires accepting that the rate of return in sector I will be lower than in other sectors. He explicitly relies on Marx’s analysis of reproduction in Vol 2 to justify this: As to Marx, he, as we know, did not like to digress from his investigation of the laws of capitalist production, and did not, in his Capital, discuss the applicability of his schemes of reproduction to socialism. However, in Chapter XX, Vol. II of Capital, in the section, “The Constant Capital of Department I,” where he examines the exchange of Department I products within this department, Marx, as though in passing, observes that under socialism the exchange of products within this department would proceed with the same regularity as under the capitalist mode of production. He says: “If production were socialized, instead of capitalistic, it is evident that these products of Department I would just as regularly be redistributed as means of production to the various lines of production of this department, for purposes of reproduction, one portion remaining directly in that sphere of production which created it, another passing over to other lines of production of the same department, thereby entertaining a constant mutual exchange between the various lines of production of this department.”(Stalin is quoting Marx :Karl Marx, Capital, Eng. ed., Vol. 2, Chapter 20, Section 6.) Volume 2 and the analysis of reproduction is not only a sound basis for an intial theory of socialist planning. It is the fundamental explanation of why the law of value must operate in a capitalist economy it that is to reproduce itself. Volume 3 on the other hand, whilst it contains a lot of good stuff, has an incorrect Ricardian theory of price. Marx at times believed that he had made a breakthrough here. He was mistaken. The theory is empirically wrong, leads to inconsistent and non-reproducible social accounting. Marx wrongly believed that “differences in the average rate of profit in the various branches of industry … could not exist without abolishing the entire system of capitalist production.” whereas in reality, any attempt to impose an equal profit rate would render the capitalist economy unable to reproduce itself. AuthorPaul Cockshott is an economist and computer scientist. His best known books on economics are Towards a New Socialism, and How The World Works. In computing he has worked on cellular automata machines, database machines, video encoding and 3D TV. In economics he works on Marxist value theory and the theory of socialist economy. This article was produced by Paul Cockshott. Archives March 2022

0 Comments

Leave a Reply. |

Details

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed